another day on the road to

Wealth & Means

Divide your portion to seven, or even to eight.

This advice given by King Solomon in this verse found in Ecclesiastes 11:2, can be interpreted in a few different ways, but one common interpretation is about the importance of diversification and prudence in one's investments or resources.

By advising to "divide your portion to seven, or even to eight," Solomon may be suggesting that it's wise to diversify one's investments or resources among multiple avenues rather than putting all of one's eggs in one basket. This diversification can help mitigate risk and provide a cushion against unforeseen misfortunes or disasters.

Furthermore, he continues, “for you do not know what misfortune may occur on the earth." This underscores the unpredictability and uncertainty of life. It's a recognition that no one can predict with certainty what challenges or hardships may arise in the future, so it's prudent to spread out one's resources to increase resilience and adaptability.

Yes, after accumulating wealth, diversification is a fundamental principle in protecting it. There are various levels of diversification people frequently use. Here are seven common dimensions of diversification:

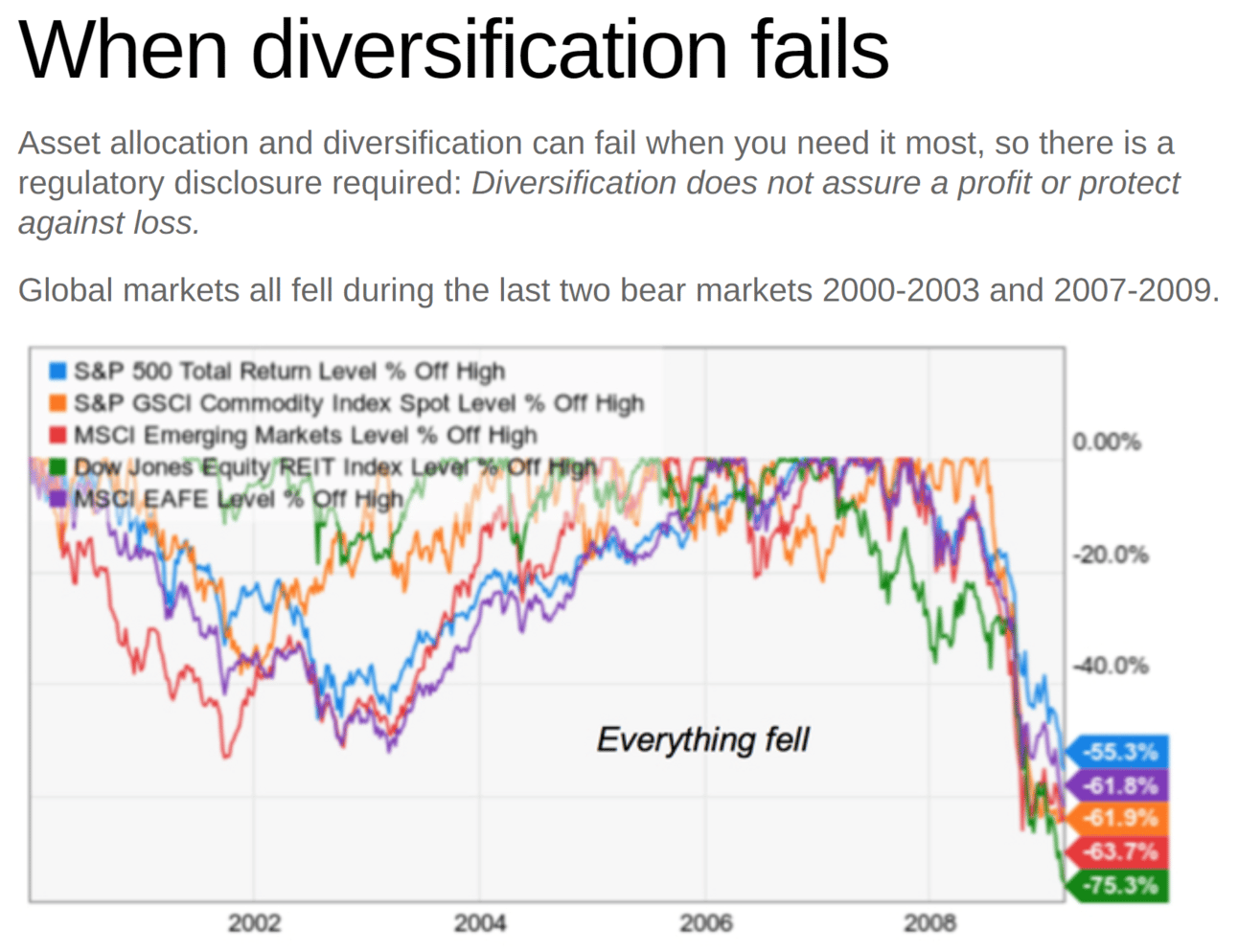

1. Asset Classes: This is the most basic level of diversification, where investors spread their investments across different asset classes such as stocks, bonds, real estate, and commodities. Each asset class tends to have different risk-return characteristics, so by diversifying across them, investors can reduce overall risk if the assets are uncorrelated.

2. Individual Securities: Within each asset class, investors can further diversify by investing in a variety of individual securities. For example, instead of putting all their money into a single stock, they might invest in a portfolio of different stocks in a sector or theme. Exchange Traded Funds (ETFs) enable sector, asset, and factor selection.

3. Geographic Diversification: Investors can also diversify geographically by investing in assets from different countries or regions. This can help mitigate risks associated with political instability, economic downturns, or currency fluctuations in any single country or region. It is possible to select ETFs that cover different geographies. Some countries only allow investors who reside in India.

4. Industry or Sector Diversification: Even within a single asset class, investors can diversify by investing in different industries or sectors. For example, within the stock market, they might hold stocks in technology, healthcare, finance, and consumer goods companies to spread out sector-specific risks.

Put your eggs in many baskets.

5. Number of Holdings: Some investors aim for a specific number of holdings in their portfolio to achieve diversification. While there's no magic number, some might aim for 20, 30, or even more individual assets to spread out risk effectively.

6. Factor Diversification: This involves diversifying across factors such as size, value, growth, and momentum. By investing in assets with different factor exposures, investors can further diversify risk and potentially enhance returns.

7. Time Diversification: This concept suggests spreading out investments over time rather than investing a lump sum all at once. By dollar-cost averaging or investing regularly over time, investors can reduce the impact of market volatility and potentially benefit from buying assets at different price points. Another form of this is through selecting assets that pay dividends on weekly, monthly, or quarterly schedules.

Your appetite for diversification will change over the years as you transition from wealth formation and accumulation to preservation. At later stages when you are consuming your wealth you will want to ensure funds are dispersed across a reasonable number of banks, institutions, and assets to avoid concentration or systematic risk.